With the aggressive global launch of 5G technology and associated “Edge” infrastructure expansion, in conjunction with the ongoing investments in 4G/LTE densification, the complex IoT ecosystem is undergoing a significant and exciting “reboot”. This ecosystem includes an increasingly diverse set of regional and global players and stakeholders:

- Webscalers [i.e., AWS, Azure, GCP]

- Datacenter Colocation Providers [e.g., Equinix, CenturyLink]

- Network Equipment OEMs (SW, HW) [e.g., Nokia, Ericsson, Microsoft, Huawei, Cisco]

- Industrial Equipment OEMs [e.g., Bosch, Siemens, PTC]

- Mobile Operators [e.g., Verizon, AT&T, Bell Canada, Rogers, Vodafone, Telefonica]

- Mobile Chipsets [e.g., Qualcomm, Nvidia (Arm)]

- Mobile Devices [e.g., Apple, Samsung]

- Content Delivery Networks (CDNs) [e.g., Akamai, Cloudflare]

- SaaS Leaders [e.g., SAP, Oracle, Salesforce, ServiceNow, Pega]

- System Integrators (SIs)/Consulting Operations [e.g., Accenture, Deloitte, IBM, Tata, McKinsey]

- Industry Associations/Alliances (e.g., GSMA, TM Forum, 5GAAA, O-RAN]

- Standards Bodies [e.g., IEEE, ITU, IETF]

- Academia

- Government [Municipal, State/Provincial, Federal]

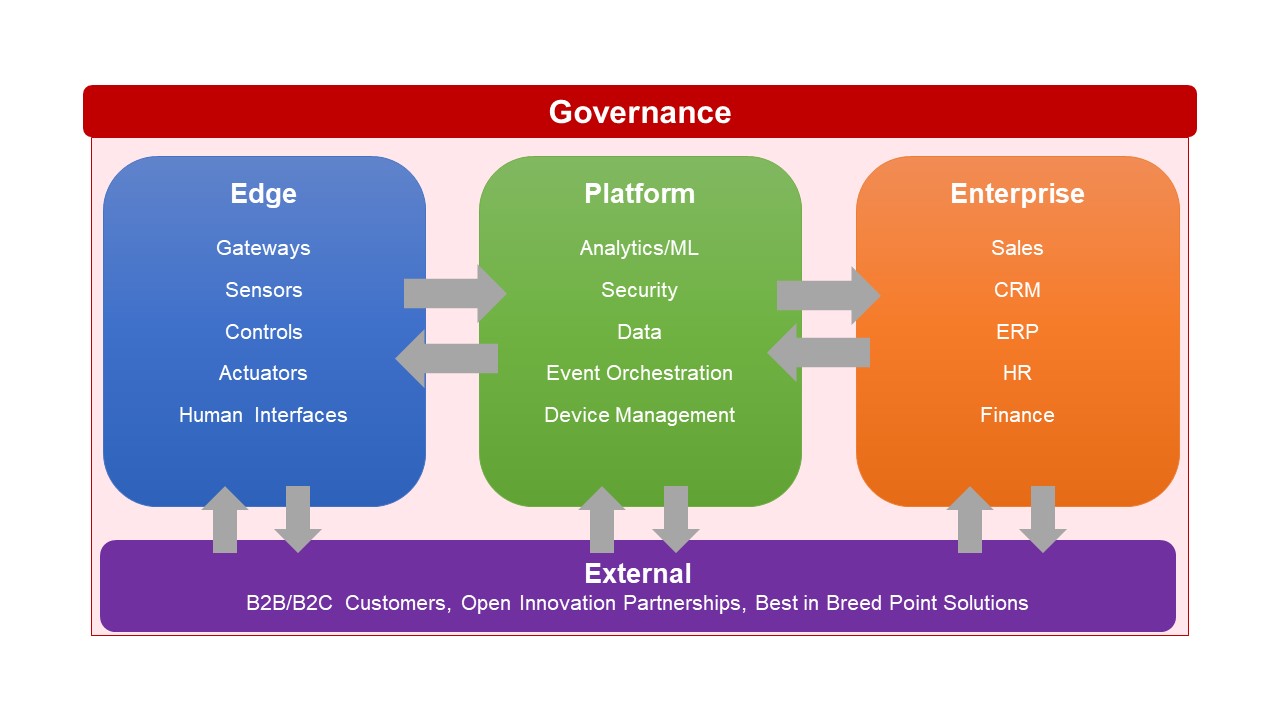

To better understand this complex ecosystem and the related emerging B2C/B2B IoT commercial landscape, an “IoT Reference Architecture” model (see figure below) will be invaluable.

IoT Reference Architecture

The IoT Reference Architecture Model as captured above consists of 5 key components as described below.

- Edge – This is where data is sampled and collected by a combination of smart “things” and gateways that interconnect with the core Platform element and interface with various context specific External (or Public) data source elements. These interconnections span both “traditional” wired and wireless domains.

- Platform – This is where input data from the Edge is stored and processed for integration with the Enterprise element. Also, the Platform interfaces with various External best in breed “point solutions”.

- Enterprise – This architectural component represents the diverse business applications and services enabled by the Platform driving diverse and relevant smart business data to diverse stakeholders.

- External – This refers to a mix of B2C and B2B customers, third party innovation engagements and partnerships, as well as a collection of IoT use case point solutions.

- Governance – This consists of the integration of business, IT, and enterprise architecture governance and application to the IoT solution context.

Unpacking the Edge

As highlighted elsewhere in a related McGill 5G blog, the “Race to Control the Edge” will represent one of the iconic competitive battles that will unfold over this next decade and beyond. Given that IoT, 5G, and the “Edge” are in many ways joined at the hip, it is worthwhile to further explore the “Edge” and how it plays within the broader cloud environment. In a nutshell, Edge Computing enables a distributed computing architecture in which key data and information processing is pushed closer to the physical location where people, businesses, and “things” digitally connect. In this way, Edge Computing enhances and complements the solutions associated with today’s (for the most part) centralized cloud computing infrastructures.

The Edge can also be viewed (as shown in the figure below) to consist of several components including the so-called “Far Edge” (located at the customer premises) and “Near Edge” (located at an intermediate point and housing key mobile 5G/LTE/network compute processing capabilities to address a diverse set of devices and workloads at the Edge).

So how does IoT then fit within this Edge Computing architecture? As per a recent Gartner report:

“All IoT use cases do not require edge computing, but edge computing increases the possibilities and use cases of IoT significantly — whenever more real-time processing is critical, when data is being produced in large quantity or when it’s important to ensure continued operation during network downtime.”

IoT Security Considerations

As the number of IoT enabled devices explodes over the next decade, the resulting security implications represent a significant commercialization challenge. As such, an effective IoT security strategy necessarily requires the deployment of industry specific best practices and frameworks complemented by the integration of appropriate tools and procedures spanning the entire IoT ecosystem and value chain. Key elements of this security strategy encompass devices, data transmission, network infrastructure and applications, and users/digital identity. All these elements certainly must adhere to robust security governance (which is a core component of the overall IoT solution governance mentioned above) that includes well defined policies and processes (e.g., privacy, ownership, connectivity, support), applicable industry specific standards and regulations, and high system resiliency and availability.

IoT Platform Solutions – Scalability Considerations

Given the stakeholder diversity mentioned earlier, there is a heightened competitive intensity rapidly unfolding across the commercial landscape to control the all-important “Platform” element [see IoT Reference Architecture Model above]. IoT pilots/scaled deployments typically start with an industry specific use case and related “best in class” point solution. For example, a smart city “public safety” use case may involve the deployment of HD cameras in various target locations. These deployed cameras can then be use case extended to efficiently tackle, for example, city traffic management. As such, the scalability of these IoT “Platforms” needs to address both use case extension scenarios as well as integration of distinct point solutions. Often, these scalability concerns result in creative GTM approaches, more specifically, large system integrators (SIs) typically like to position themselves as “Platform agnostic” and offering a so-called “Platform of Platforms” capability.

IoT Standards and Technologies

IoT standards will play an increasingly critical role as the complexity and commercial stakes escalate in the coming years. The standards focus on a wide spectrum of components within the IoT solution ecosystem including infrastructure, device discovery, data protocols, device management, device identification and communications/connectivity. On the infrastructure side, the often talked about internet address apocalypse within the context of existing IPV4 networks has morphed into a more pragmatic discussion about accelerating concrete plans for a continued smooth and efficient transition to IPV6 to address the coming IoT device explosion (see Table below).

|

|

IPV4 |

IPV6 |

|

Deployed |

198Os |

1990s |

|

IP Address Size |

32 bits |

128 bits |

|

# of IP Addresses |

232 ~ 4.3 Billion |

2128 ~ 340 trillion trillion trillion! |

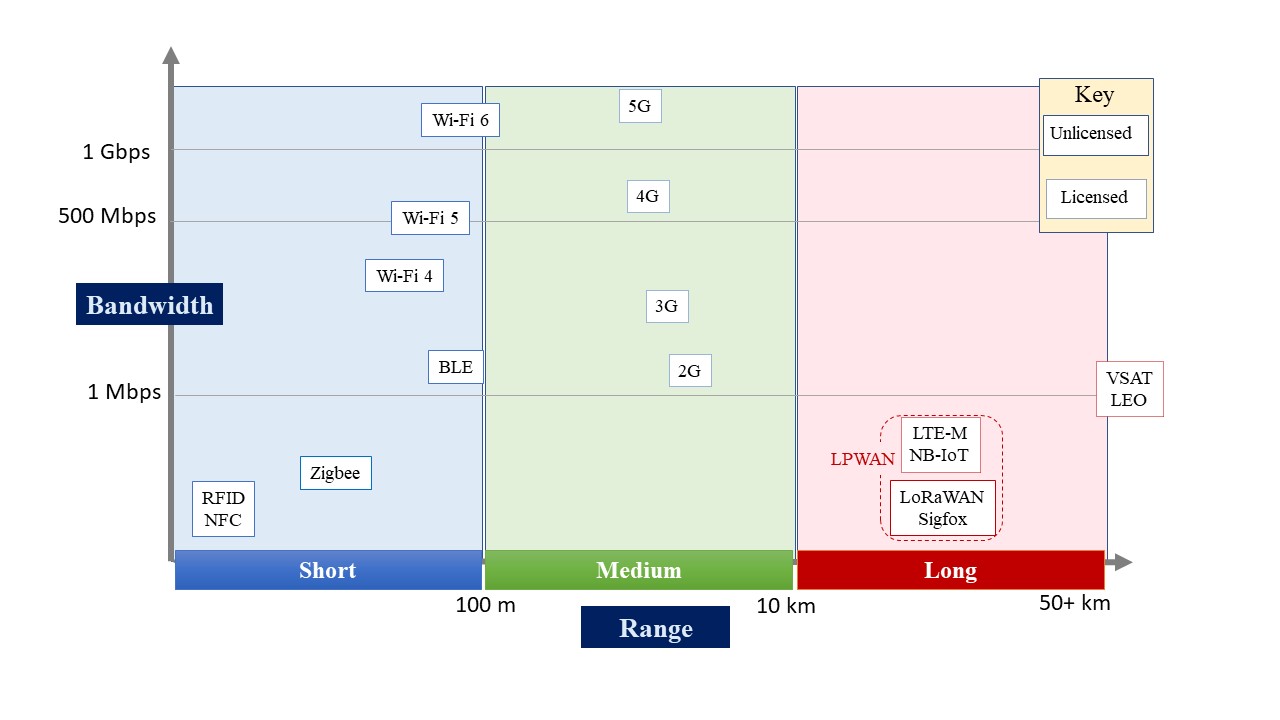

On the IoT connectivity technology side, the diversity of commercialization options reigns supreme (see figure below). Key considerations in the IoT connectivity use case decision tree include range, bandwidth, module/infrastructure cost, power and licensing requirements. Recent technology launches including 5G, Wi-Fi 6, and licensed low power wireless access network (LPWAN) such as NB-IoT and LTE-M have begun to dramatically reshape the IoT connectivity space. These licensed LPWAN offerings complement and compete with the non-licenced (aka non-cellular based) solutions such as LoraWAN and Sigfox that were launched over the last decade with some early success. Additional disruption avenues involving (1) the broader satellite sector (including the launch of Low Earth Orbit [LEO] solutions), (2) expansion of the blockchain ecosystem (e.g., digital identity, IoT supply chain, network resource sharing) and (3) expected maturing over the second half of this decade of intriguing quantum computing driven IoT use cases (e.g., IoT cybersecurity) are ensuring a very dynamic and competitive IoT connectivity landscape for the foreseeable future.

How 5G “Changes The Game” in the IoT Technology/Solutions Landscape

As mentioned in a previous McGill 5G related blog article, 5G brings to the table a bewildering spectrum of innovation by virtue of its support for an approximate 10X factor improvement in increased bandwidth, connection density and latency reduction. To better understand what these significant performance gains mean from an IoT perspective, let’s explore the emerging cellular IoT solution segments.

- Massive IoT – Low-cost devices, low data volumes, and long range (extreme) coverage (up to 10s of km). Examples – Smart Metering, Fleet and Asset Management

- Broadband IoT- High data rates (up to hundreds of Mbps and even Gbps), large data volumes, and ‘best effort’ low latency. Examples – Drones/UAVs, AR/VR

- Critical IoT – Bounded latencies, ultra low latency, ultra reliable data delivery, ultra high availability (e.g., 99.9999%). Examples – Smart Grid Control, Traffic Safety, and Self -Driving Transport

- Industrial Automation IoT – Time Sensitive Networks (e.g., Industrial Ethernet), Precise indoor positioning. Examples – Advanced industrial automation and control, Robotic control and orchestration

Over the last 5 years, the Massive IoT and Broadband IoT segments were initially supported within the 4G/LTE network, with admittedly muted success (due to mostly high cost and delayed standards developments). The global 5G launch (1) supports an evolution of these two segments with enhanced capabilities and performance and (2) introduces two new “game changing” segments in Critical IoT and Industrial Automation IoT. Mapping the above four cellular IoT solution segments to the various industry verticals illustrates the rich spectrum of 5G powered IoT use cases. What a brave new world indeed!

|

|

Cellular IoT Segment |

|||

|

|

Massive IoT |

Broadband IoT |

Critical IoT |

Industrial IoT |

|

Industry Vertical |

|

|

|

|

|

|

|

|

|

|

|

Public Safety |

Y |

Y |

Y |

N |

|

Media Production |

N |

Y |

Y |

Y |

|

Manufacturing |

Y |

Y |

Y |

Y |

|

Agriculture |

Y |

Y |

Y |

N |

|

Automotive |

Y |

Y |

Y |

N |

|

Entertainment |

Y |

Y |

Y |

N |

|

Mining |

Y |

Y |

Y |

Y |

|

Transport |

Y |

Y |

Y |

N |

|

Smart Cities |

Y |

Y |

Y |

N |

|

Education |

Y |

Y |

Y |

N |

|

Construction |

Y |

Y |

Y |

N |

|

Oil and Gas |

Y |

Y |

Y |

Y |

|

Healthcare |

Y |

Y |

Y |

N |

|

Finance |

Y |

Y |

Y |

N |

|

Ports |

Y |

Y |

Y |

Y |

|

Maritime |

Y |

Y |

Y |

N |

|

Forestry |

Y |

Y |

Y |

N |

|

Utilities |

Y |

Y |

Y |

Y |

|

Warehousing |

Y |

Y |

Y |

N |

As an enterprise starts to plan for this 5G powered IoT solution innovation and opportunity landscape, it is helpful to review what has contributed to the recent successes and failures of various IoT pilots and scaled deployments. This will help prepare the ground for winning in this emerging 5G powered IoT Brave New World. This is explored in the ensuing McGill blog post titled “Part 3: Preparing the Ground to Win in the 5G Powered IoT Brave New World”.

Discover the Workshop!