The Bank of Canada has announced the top three proposals of the Model X Challenge, a project seeking new designs and business models from North American institutions for Central Bank digital currency (CBDC). These proposals help the Bank of Canada explore the best solutions for digital currency systems if the decision is made to issue a CBDC.

Among the leading participants are McGill University researchers, Prof. Katrin Tinn (Desautels Faculty of Management) and Prof. Christophe Dubach (Faculty of Engineering).

As the move towards digital payment methods increases, so does the need for more secure and compliant systems of digital currency. Their proposal, “Central Bank Digital Currency with Asymmetric Privacy,” investigates safe, accessible, and efficient applications of CBDC.

“We propose a novel, implementable technical solution using a Proof-of Authority-based blockchain and a Zero-Knowledge Proof approach for private coin ownership,” describes Prof. Dubach.

“These design features have been chosen to ensure privacy of spending, system transparency, and compliance with tax and anti-money laundering regulations, without compromising scalability.”

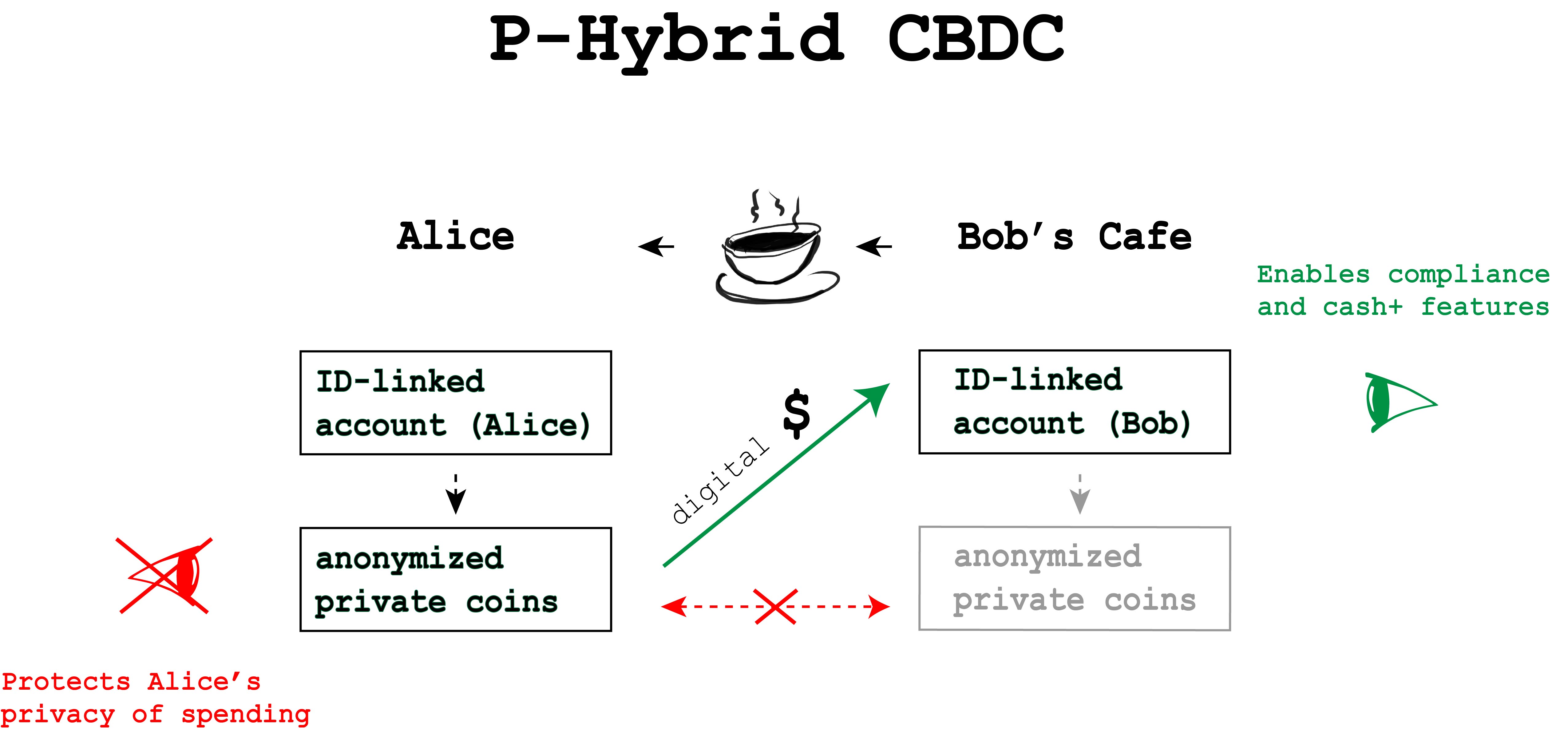

Their solution, a Privacy-Hybrid CBDC, involves intentional asymmetry between the privacy of the digital currency spender and the privacy of the digital currency recipient. Using this model, the identity and transactions of the individual spender are protected, while those of the recipient are documented and validated for transparency.

Figure: Privacy-Hybrid CBDC

Figure: Privacy-Hybrid CBDC

“This type of hybrid design could help resolve many of the current privacy and compliance concerns associated with CBDC, and has the potential for financial institutions and technology firms to offer new and better services,” says Prof. Tinn.

A key aspect of the Model X Challenge was the partnership between business and computer science researchers. Through combining their economic and technical expertise, Tinn and Dubach were able to develop the Privacy-Hybrid CBDC model and address the challenges of previous designs.

“The project offered an exciting collaboration opportunity between McGill’s Finance and Computer Science and Engineering areas” says Prof. Tinn. “We also look forward to engaging in fruitful debates with the other teams.”

Read the complete report here: Central bank digital currency with asymmetric privacy

Katrin is an Assistant Professor of Finance at Desautels Faculty of Management at McGill University. Her research focuses on theoretical modelling, technological innovation, financial economics, information economics. Her most recent work is on FinTech and the role of crowdfunding and distributed ledger technologies (blockchain) in raising external capital and facilitating learning about future demand. Her research has been published in prominent journals, such as the American Economic Review, Management Science and Journal of Economic Theory, and she has presented her research at academic conferences including the Annual Conferences of the American Finance Association, the Western Finance Association, the American Economic Association, as well as FinTech focused conferences in Canada, France, Switzerland and the United Kingdom. She has also written book chapters for editions focused on alternative finance, blockchain, and digital currencies (Palgrave-MacMillan, World Scientific Publishers, and VoxEU’s e-book series). Katrin holds a M.Sc. in Economics from University College London and a Ph.D. in Economics from London School of Economics.

Christophe is an Associate Professor jointly appointed at the department of Electrical and Computer Engineering, and the school of Computer Science at McGil University. He has co-authored over 50 research papers in the computing system community and regularly sits on the program and organizing committee of major conferences in the field. His current research interests include the automatic optimization of computing systems from software to hardware using, and for, machine learning. He has a strong interest in crypto-currencies and has been following most associated developments since 2011. Christophe received his Ph.D. in Informatics from the University of Edinburgh (UK) in 2009 and holds a M.Sc. degree in Computer Science from EPFL (Switzerland). In 2010 he spent one year as a visiting researcher at the IBM Watson Research Center (USA) working on the LiquidMetal project. This project aims to accelerate workloads requiring high throughput and low latencies such as high frequency trading applications on high performance accelerators.